On Tuesday, European stocks edged higher ahead of a critical speech on China trade relations, from the President Donald Trump, supported by generally well received earnings. The Stoxx Europe 600 SXXP that finished Monday only 2% below its record close, surged 0.12% to 405.81. The German DAX gained 0.29% to 13236.76, the French CAC increased 0.15% to 5902.52 and the U.K. FTSE 100 rose 0.28% to 7349.30.

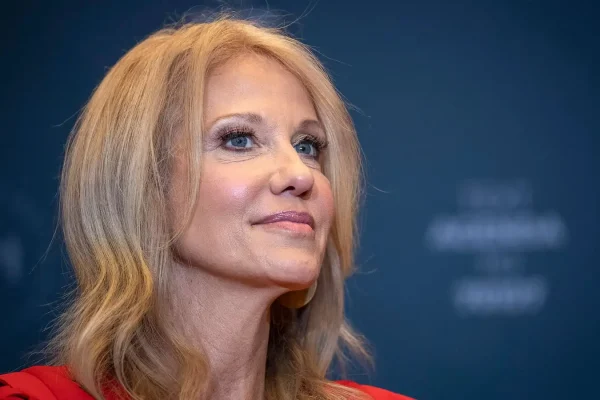

At 12 p.m. Eastern, Trump is due to deliver a speech to Economic Club of New York.

The chief economist at UBS Global Wealth Management, Paul Donovan said that, “Whatever the tone of the remarks, the effect on markets is likely to be short term. We are just a tweet away from a policy change, and the next communication on trade could reverse market assumptions.”

Infineon Technologies (IFX) stock surged 5% as the German chip-maker reported better fourth-quarter revenue and the operating profit than forecast, and also helped by its unit that produces chips for smartphones. The Infineon’s outlook implies the strong sales growth in second half of its fiscal year, according to Gianmarco Bonacina, who is an analyst at Equita, the Italian broker.

Vodafone Group (VOD) shares rose 1% as the U.K.-based mobile-phone operator also lifted its guidance for fiscal 2020, with adjusted earnings to imply 2% to 3% organic growth. Company’s first-half organic adjusted Ebitda gained 1.4% on 0.3% growth in service revenue, fueled by gains in South Africa, Spain and Italy.

Electrocomponents (ECM) shares slumped 13.6% on Tuesday, as the distributor of industrial and electronics products said that the second half started with modest growth with ongoing softness in electronics.

B&M European Value Retail (BME) shares tumbled 7.3%, as the discount retailer experienced a worse than expected 2.8% fall in adjusted pretax profit, as it reported continued disappointing financial performance in Germany and the slowing down of same-store sales growth at its U.K. stores.