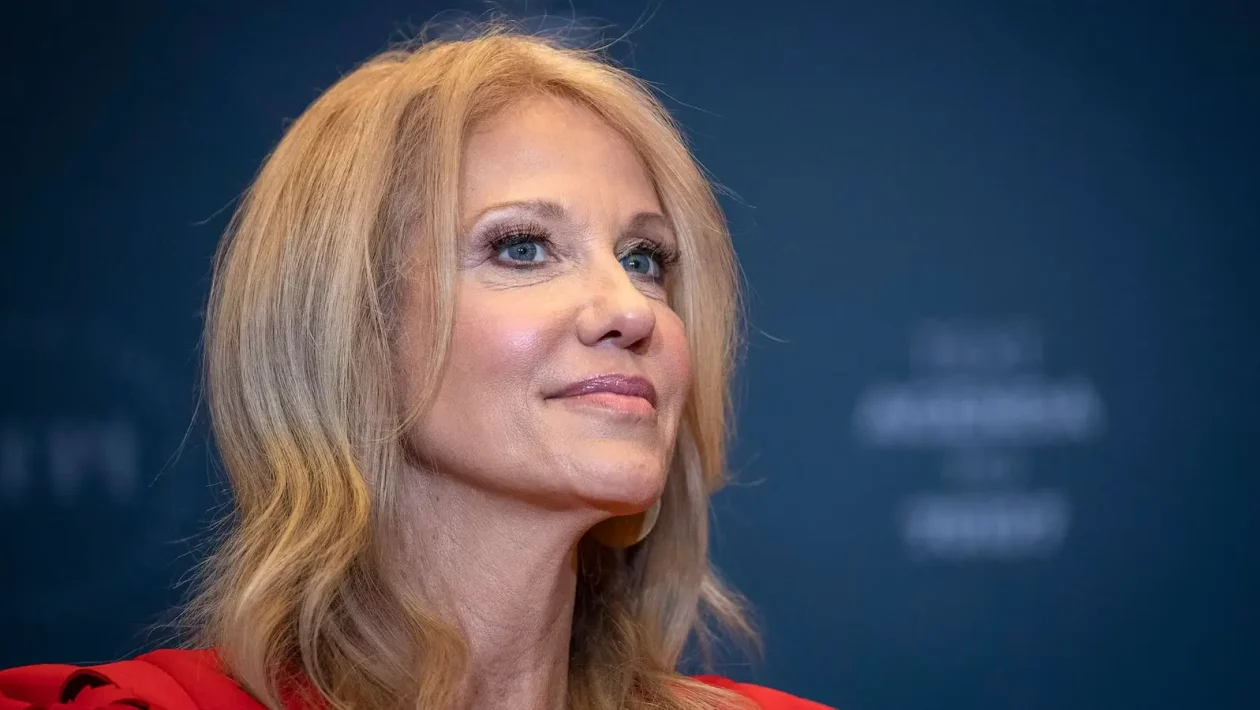

The wife of Attorney George Conway, Kellyanne Conway, who works as a counselor to President Donald Trump, said on Monday in a Washington Post op-ed that he had no more doubt that the president is a racist.

Kellyanne Conway who initially supported Donald Trump but now she become one of the president’s fiercest critics, since he took the office, said that despite his ongoing problems with Trump he had held off judging him to be a bigot.

On Sunday, after Trump’s tweets telling a group of minority of the Democratic congresswomen three of whom were born in United States, to go back to countries they originally came from, now he could no longer in the position to avoid conclusion.

Conway said that, “No, I thought, President Trump was boorish, dim-witted, inarticulate, incoherent, narcissistic and insensitive. He’s a pathetic bully but an equal-opportunity bully – in his uniquely crass and crude manner, he’ll attack anyone he thinks is critical of him. No matter how much I found him ultimately unfit, I still gave him the benefit of the doubt about being a racist,”

“But Sunday left no doubt. Naivete, resentment and outright racism, roiled in a toxic mix, have given us a racist president.”

He said Trump’s comments about Reps. Alexandria Ocasio-Cortez of New York, Ilhan Omar of Minnesota, Ayanna Pressley of Massachusetts and Rashida Tlaib of Michigan were “racist to the core.”